Let's play!

Welcome to Broadway Joe's Fantasy Sports, where you can play along with the pros!

Bringing you the Ultimate Experience in Fantasy Sports!

Whether you're drafting your dream team or enjoying a game with family and friends, excitement is always on the menu.

Accelerated versions of the traditional fantasy format in which contests are conducted over shorter periods than a full season, often lasting one week or even a single day.

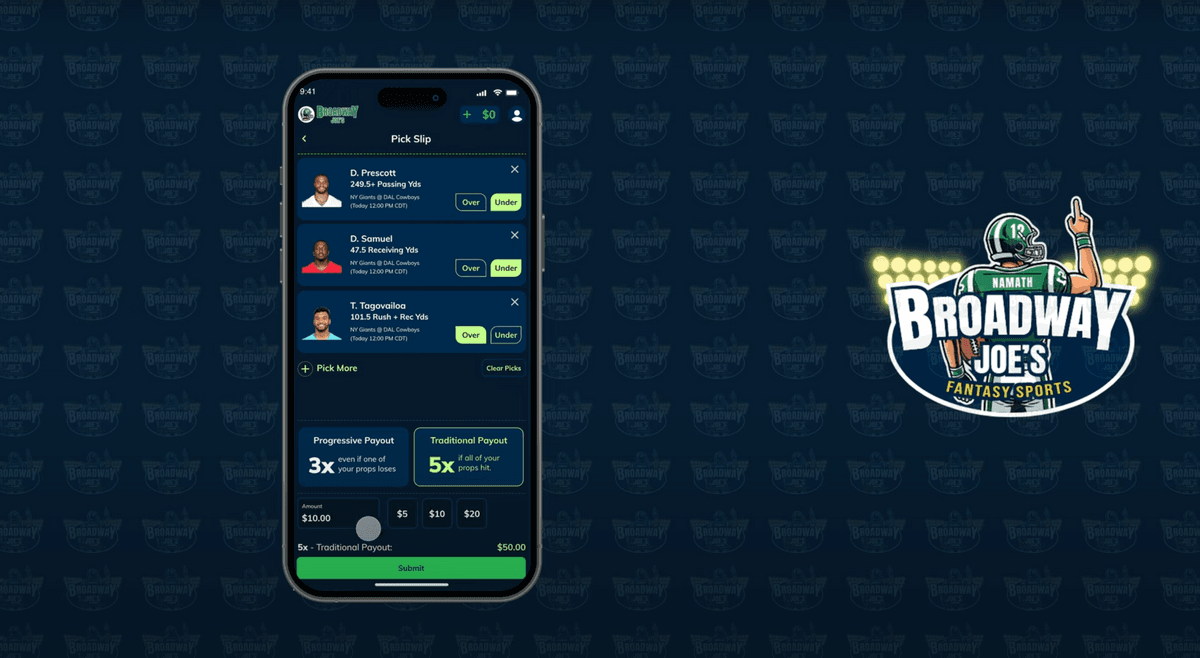

Play with your favorite teams and players with our prop-style gaming options. It's a new way to play and win big on game day.

Enjoy all your favorite sports in one place. Play fantasy sports like never before with our cutting-edge online platform.

Take a tour of our platform:

or call us directly at (800) 807-5969

The Opportunity

The North American fantasy sports market is estimated to be $13.2 billion in 2024, and is expected to reach $24.2 billion by 2029 growing at a Compounded Annual Growth Rate (CAGR) of 12.90% between 2024 and 2029.

Our Solution

Leveraging the Broadway Joe's brand to create a unique fantasy sports platform.

Joe Namath

Inspired by legendary Hall of Fame quarterback Joe Namath.

Industry Overview

The North American Fantasy Sports Market is moderately competitive and has gained a competitive edge in recent years.

In terms of market share, few significant players currently dominate the market. These major players with a prominent market share focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

According to Vox Media, LLC., The DFS industry is currently dominated by two companies, DraftKings and FanDuel, which account for more than 90% of the market share in the United States. While FanDuel was one of the chief movers in the DFS space and the clear business leader, DraftKings has outdone it for the No. 1 spot, with Yahoo Daily Fantasy and FantasyDraft vying for No. 3.

While daily fantasy football has forever been king in DFS, daily fantasy basketball has become much more prominent in recent years. A fantasy based on the NBA is much like it is for the NFL. The legitimacy of daily fantasy sports is currently the most significant issue in the region. In most utmost jurisdictions globally, DFS has recognized a gambling product and needs a gaming license to run. In North America, the legality of DFS is usually manageable.

Fantasy Sports Legal Issues in the US

Legal Framework of Fantasy Sports in the US

Fantasy sports are generally considered to be a form of gambling, though they are far less strictly regulated than other forms of sports betting. Unlike traditional sports betting, fantasy sports are generally viewed as "games of skill," rather than "games of chance," thus exempting them from gambling bans and regulations in many jurisdictions.

Though it is still an emerging industry in the region, the Supreme Court struck down the Professional and Amateur Sports Protection Act two years ago, and sports betting has been legalized federally. Sports betting was outlawed under PASPA, except for Nevada and a few other states. States are now free to legalize sports betting and begin their initiatives after the ban was overturned. The business sector has been booming and on fire. Since last year, the market has expanded from 19 states to 32 states plus Washington, D.C.

Target Market

Market Demographics

| Fantasy Player Demographics | |

|---|---|

| 64% Male, 35% Female | |

| 48% between the ages of 18-34 | |

| 84% have a college degree or higher | |

| 65% make more than $50,000 annually | |

| Sports Bettors Demographics | |

|---|---|

| 60% Male, 39% Female | |

| 38% between the ages of 18-34 | |

| 79% have a college degree or higher | |

| 63% make more than $50,000 annually | |

| What do season-long fantasy sports players play? | ||

|---|---|---|

| 79% of fantasy participants play fantasy football | ||

| 32% play fantasy basketball (NBA) | ||

| 22% play fantasy baseball (MLB) | ||

| 12% play fantasy hockey (NHL) | ||

| 11% play soccer | ||

Joe Namath Appears on Alabama's Beat Everyone Podcast

Presented by Broadway Joe's Fantasy Sports

or call us directly at (800) 807-5969